Universities spending tens of millions to financially support students, as maintenance loans fail to keep up with inflation

17 January 2024

Russell Group universities are spending tens of millions of pounds each year to support students through financial challenges, as maintenance support fails to keep step with the rising cost of living.

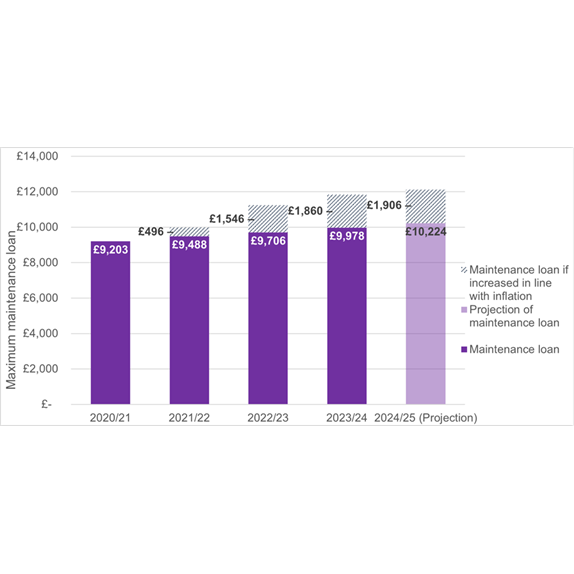

As universities increase their support for students, the Russell Group warns that cost-of-living challenges are being amplified by the growing shortfall in maintenance loans, which have failed to keep up with inflation. New Russell Group projections reveal that students in England will be almost £2000 worse off next year than if the government had increased loans in line with inflation since 2020/21.

The shortfall is compounded by the freeze on the parental earnings threshold used to calculate maintenance loans in England. Students with a household income of less than £25,000 are eligible for the maximum loan, but this figure has been frozen in cash terms since 2008. It is estimated that had this threshold increased with earnings, it would now sit at £35,000, making many more students eligible for the maximum support.

The new analysis comes alongside figures that show universities in the Russell Group collectively are spending seven-figure sums on direct financial aid and non-financial support measures in this academic year. A third of Russell Group universities operated food banks for students, while many have drastically increased their bursary and hardship funds to counteract rising living costs.

Other support measures funded by universities include free and low-cost meals, free and subsidised travel, technology loans and money management advisors, as well as enhanced bursaries, grants and rent guarantor schemes for students from under-represented groups, who are at the most risk of dropping out of their studies because of financial challenges.

A 2023 survey of Russell Group students revealed that 94% had concerns about living costs, while 1 in 4 were regularly going without food and other necessities due to financial hardship – a figure that rises to more than 3 in 10 for students from the most socioeconomically disadvantaged background.

Joanna Burton, Head of Policy (Higher Education) at the Russell Group, said:

"Students are a significant but often overlooked casualty of rising cost-of-living pressures, and our universities are doing what they can to step up support, whether through financial support or measures like subsidised food and travel. However, we can’t do this on our own, and wider Government support is needed so students have enough money to live on. We continue to urge the Government to uplift maintenance loans to reflect real annual inflation, as well as the reintroduction of maintenance grants that were previously a lifeline for the most disadvantaged students.

"During the pandemic our sector worked successfully in partnership with the Government to maintain student safety and continue quality education. We can learn lessons from this and once again work together to ensure students are supported to thrive in their studies, without worrying about whether they can afford essentials."

Shaban Chaudhury, Education Officer at Students’ Union UCL, said on behalf of the Russell Group Students’ Unions:

"Last year, we called on the Government to increase maintenance loans to reflect real inflation. Unfortunately, we are yet to see this materialise, with no co-ordinated approach for targeted support for students from the Government.

"Across our institutions, the impact of the cost-of-living crisis continues to be systemic and widespread, with the lack of centralised Government support suggesting a concerning acceptance of student suffering. Indeed, many students are now reliant upon bursaries, hardship funds, and foodbanks for survival.

"Today, echoing the Russell Group, we restate our ask. Maintenance loans must rise in line with inflation, grants must be reintroduced to support our most disadvantaged students, and the parental threshold for maximum student finance support, which has been frozen since 2008 despite average earnings increasing significantly, needs to be reviewed. We believe that Higher Education must be accessible to all, and we must work together to ensure that all students are supported to succeed.”

Notes to editors

Maintenance loan shortfall calculation: should the DfE uprate maintenance loans for 2024/25 by the most recent projection for inflation Q1 2025 (2.5%), as expected, a full-time student living away from home outside London will receive £10,244 per year – £1,906 short of the £12,130 the loan would be if the Government had raised it in line with inflation since 2020/21.

The full Russell Group briefing, Cost-of-living support for students, can be found here.

-

Laura Peatman

laura.peatman@russellgroup.ac.uk

020 3816 1318

-

Joanna Burton

joanna.burton@russellgroup.ac.uk

020 3816 1322

-

Maddy Godin

X

X